Iras Form Ir8a - You will be directed to the page that allows you to create the form. An IR8A form is a document that all employers must submit to IRAS each year.

Ir8a Ehr Payroll Singapore Payroll Software Payroll System Singapore Payroll Sme Payroll Tms Software Time Attendance Fingerprint

The printed Form and appendices should not be sent to.

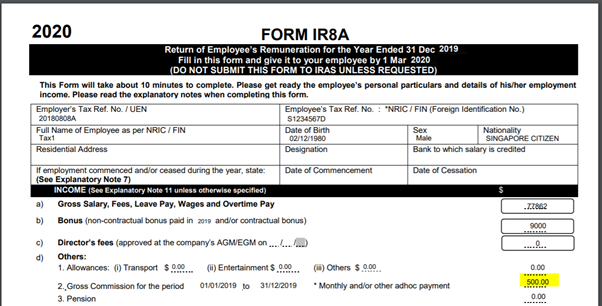

Iras form ir8a. Any donation not utilised can be carried forward to be offset against the income for any subsequent year up to a maximum of 5 years. Employers have to report the payments salary made to their employees through the Form IR8A. Step 2 of 4.

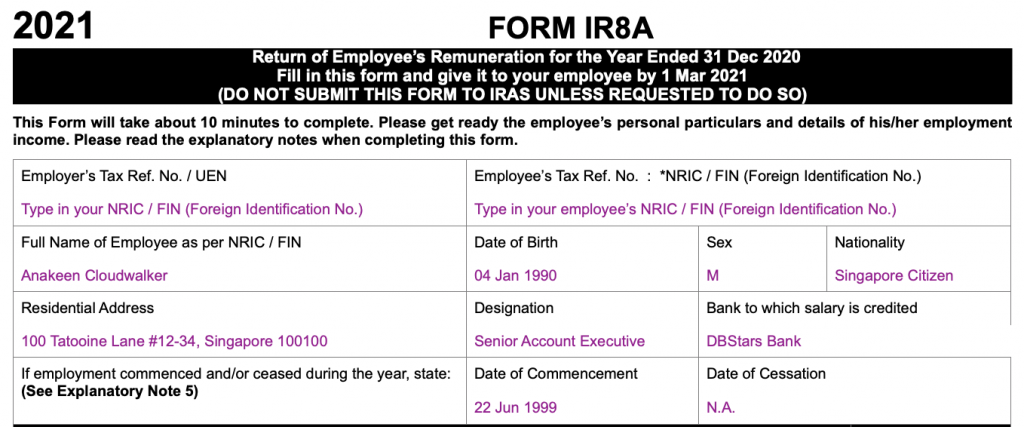

However you may print the Form 8E and appendices upon request from your employees. The whole point of filling out and submitting Form IR8A is to provide the IRAS with all the particulars on the employees earnings and benefits. The information like the employees particulars will be shown by default and cannot be edited.

Under item in the DEDUCTIONS AND RELIEFS screen enter or amend the total amount of the donations rounded up to the nearest dollar deducted through your salaries as shown on your Form IR8A. With such transmission the employee can just log into the IRAS Tax Portal to review the employment income details make the necessary personal relief claim and file the tax return. Do not send the completed forms to IRAS.

For a computer-printed Form IR8A signature is not compulsory. The completed Form IR8A andor Appendix 8A for year ended 31 Dec 2016 should be given to your employees by 1 Mar 2017. It must be completed for each employee of that company to inform IRAS of the employees incomeearnings.

However the name designation contact number of the authorised person and the date must be stated. Form IR8A or IR8E under Auto Inclusion Scheme AIS If employer participates in the Auto-Inclusion Scheme employees salary details will be electronically transmitted by the employer to the IRAS. Go to Tax Filing IR8A AIS Submission.

Notification by Employer of an Employees Cessation of Employment or Departure from Singapore. Start creating new forms for employee by clicking on the link. Alternatively employers may prefer the Auto-Inclusion Scheme AIS for auto submission to IRAS.

However the name designation contact number of the authorised person and the date must be stated. GIRO application forms for the different taxes. Feb 24 2009 at 0841 AM.

You will need print out the IR8A for every employee complete each form and give the form to each employee by 1 Mar 2021. Printing the Appendix 8A forms populates the value of benefits in kind field on the IR8AIR8S Forms - IR8A Income page. Employers who are not under the AIS for employment income on the other hand will be required to provide a hardcopy of Form IR8A and applicable appendices to their employees by 1 March annually for the filing of their income tax returns.

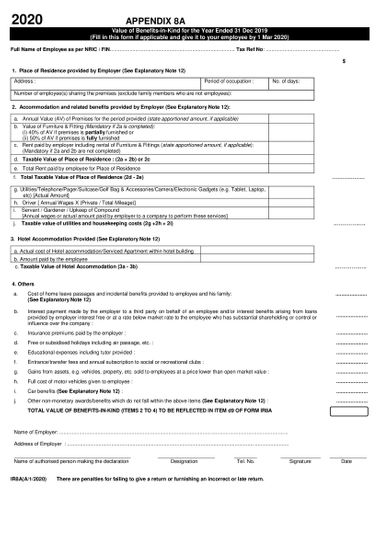

Income Tax Forms You do not need to issue Form IR8A IR8S Appendix 8A and Appendix 8B to your employees as your employees need not declare their employment income and deductions in their tax forms. Form IR8A for all employees Appendix 8A for payments of benefits-in-kind Appendix 8B gains from Employee Stock Option Form IR8S if excess CPF payments were made Please remember to submit these forms to IRAS by 1st March if youre under AIS or provide these forms to your employees by 1st March if youre not. Payroll IRAS Income Tax forms for Employers.

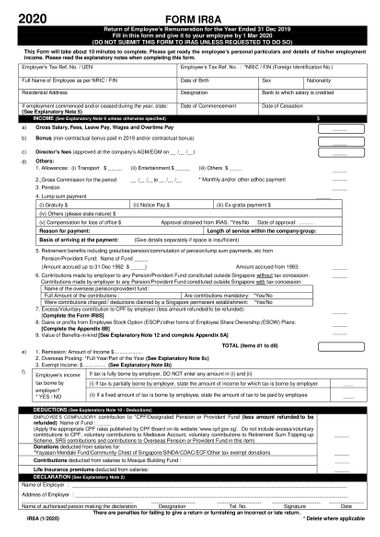

The completed Form IR8A andor Appendix 8A for year ended 31 Dec 2019 should be given to your employees by 1 Mar 2020. For a computer-printed Form IR8A a signature is not compulsory. An IR8A form is a document that must be submitted by all employers to IRAS each year.

Step 1 of 4. What is ir8a form. You are not required to print Form IR8A IR8S Appendix 8A and Appendix 8B as your employees need not declare their employment income and deductions in their tax forms.

It must be completed by each employee of that firm in order for IRAS to be informed of their wages. AIS employers will require a hardcopy of form IR8A. Form IR8A in Singapore is a mandatory document that contains information on employees earnings.

However you may wish to provide your employees with a. However the name designation contact number of the authorised person and the date must be stated. Depending on various working conditions of your employees you might need to prepare Appendix 8A Appendix 8B and Form IR8S as well.

A field on the IR8A summarizes the value of benefits in kind that an employee receives. In terms of s 682 of the Income Tax Act all employers must prepare and submit to IRAS Form IR8A and Appendices 8A and 8B or Form IR8S where applicable for every employee by 1 March each year. You may choose Master Giro application form if you wish to pay more than one of your taxes Individual Income Tax Property Tax GST or Withholding Tax.

These can be filed manually or electronically. Step 3 of 4. They are issued by the employer and relate to employees income for the preceding year.

Appendix 8A is filled for the employees who were provided benefits-in-kind from hotel accommodations to insurance premiums. The Importance of an IR8A Form. Submit forms to IRAS by completing.

Also do not send the completed forms to IRAS. Form IR8A in Singapore is a mandatory document that contains information on employees earnings. Employers will not be required to submit these forms to IRAS.

The IR8A form needs to be prepated by employer and given to each employee by 1 March of the following year. Form IR8A with accompanying Appendix 8A Appendix 8B or Form IR8S are examples of supporting papers that can be filed with Form IR8A. Consequently the IRAS uses the information to assess the personal income taxes of the individual employees.

The IR8A is a Return of Employees Remuneration It is provided to employees by their employer and supplies the information necessary to complete the employees income tax return. Return of Employees Remuneration Form IR8A for the year ended 31 Dec 2020 Year of Assessment 2021 Form IR8A DOC 126KB Form IR8A explanatory notes PDF 100KB May 2020. Select the year of assessment.

IR8E IR8A and IR8S issued by the employer relating to employee income for the preceding year. Depending on various working conditions of your employees you might need to prepare Appendix 8A Appendix 8B and Form IR8S as well. For a computer-printed Form IR8A signature is not compulsory.

Do not send the completed forms to IRAS. However employers falling into certain categories are required to submit electronically under the Auto-Inclusion Scheme AIS. Form IR8A is filed by employers to IRAS to report all employees wages to the Inland Revenue Authority of Singapore IRAS.

There are also supporting documents that may be submitted with Form IR8A namely Form IR8A and supporting Appendix 8A Appendix 8B or Form IR8S if applicable. The field becomes populated only when you run the Print Appendix 8A process.

What Is Ir8a And Who Submits It An Employer S Guide

2019 2021 Form Sg Iras Ir8a Fill Online Printable Fillable Blank Pdffiller

Form Ir8a Ir21 Return Of Employee S Remuneration Tax Clearance

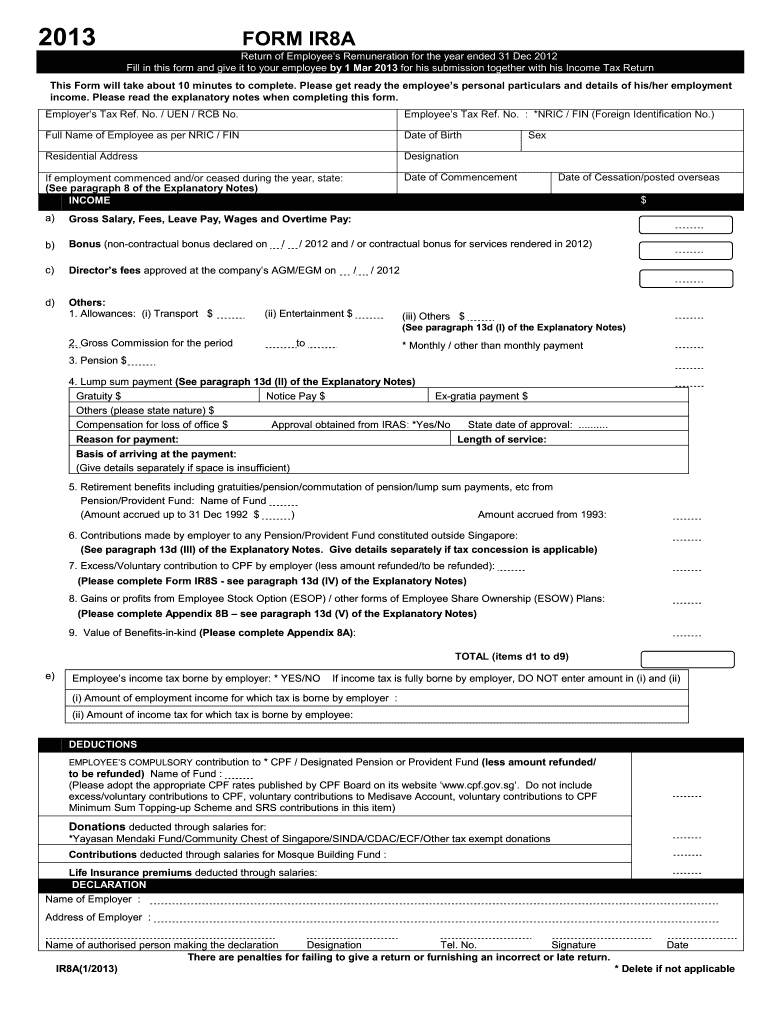

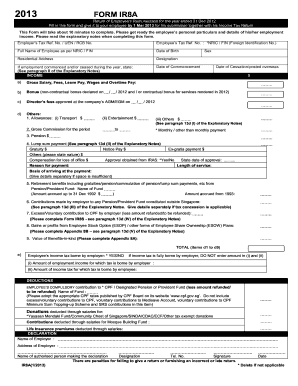

2013 Form Sg Iras Ir8a Fill Online Printable Fillable Blank Pdffiller

2019 2021 Form Sg Iras Ir8a Fill Online Printable Fillable Blank Pdffiller

Iras Guide

Additional Ir8a Forms Payroll Support Sg

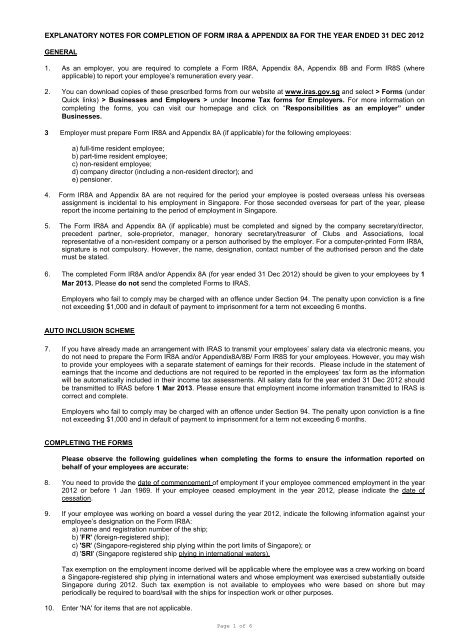

Explanatory Notes For Completion Of Form Ir8a Amp Appendix 8a Iras

2022 Form Sg Iras Ir8a Fill Online Printable Fillable Blank Pdffiller

What Is Ir8a And Who Submits It An Employer S Guide

Explanatory Notes For Completion Of Form Ir8a Iras

Ira8 Simplified For Employers Matchub

Ir8a Ehr Payroll Singapore Payroll Software Payroll System Singapore Payroll Sme Payroll Tms Software Time Attendance Fingerprint

How To Download Ir8a Form Using Deskera People