Iras Cash Payout - The Annual Value AV of your home as indicated on your NRIC as at 31 December 2020 must not exceed 21000. The third payout was announced on Oct 20 to support businesses with rental.

Guide To Annuity Fees Fidelity Investments Annuity Investing Shoppers Guide

Authorities will disburse the payouts to more than 40000 tenants and owner-occupiers without going through landlords as was the case with the first and second payouts.

Iras cash payout. First the good news. That means you can withdraw up to 10000 from either a traditional or Roth IRA before age 59 ½ without the extra 10 percent tax. Contact IRAS Eligibility check for Jobs Support Scheme payouts This e-Service allows you to enquire if you are eligible for Jobs Support Scheme based on the UEN or NRIC number that you have registered with CPFB in making CPF contributions to your employees.

You may designate your own IRA beneficiary. For individuals Ensure that your contact details with us are up-to-date to receive timely notifications. Again Roth IRA accounts are not eligible to be put in payout status.

401K and other retirement plans are treated somewhat similarly to IRAs. Even better your spouse can withdraw the. Said another way existing assets that are considered non-exempt.

For qualifying expenditure incurred on or after 1 August 2016 to YA 2018 the cash payout conversion rate is 40. It is also possible to cash out retirement plans though this usually results in early withdrawal penalties and taxes. Early withdrawals from IRAs or 401ks are both subject to a 10 penalty along with standard.

During times of financial need some people are tempted to cash out individual retirement accounts also known as IRAs. The stock markets annual average return of 8 would get you more than 475000 after 25. The scheme offered tax deductions or cash payouts to firms that had made investments to enhance productivity and innovation such as by investing in staff training information technology or.

Say you put 500 every month into an IRA that adds up to the annual maximum of 6000. Both traditional and Roth IRAs have the same contribution limits. Individuals will have to pay income taxes on withdrawals though you can split the tax payment across up to 3 years.

16 January 2015. What if I withdraw money from my IRA. If you are under 59½ youll be subject to the same distribution rules as if the IRA had been yours originally so you cannot take distributions without paying the 10 early withdrawal penaltyunless you meet one of the IRS penalty exceptions.

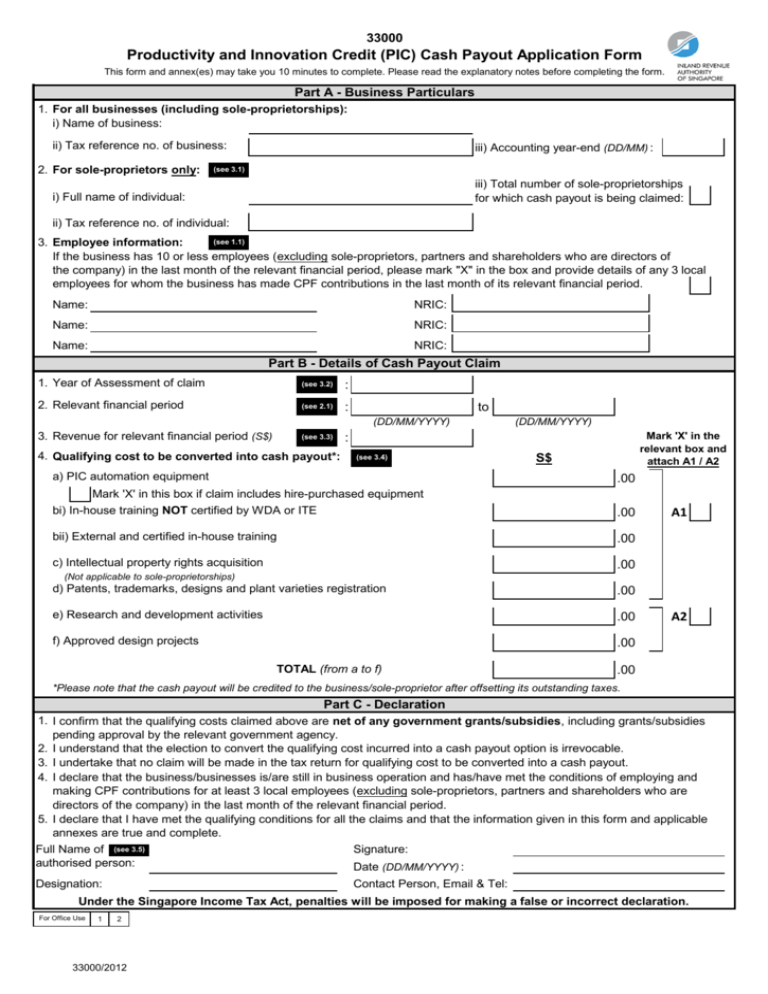

The Inland Revenue Authority of Singapore IRAS has updated its website content of the Frequently Asked Questions FAQ for the cash payout option under the Productivity and Innovation Scheme PIC Cash Payout. Your Income Earned in 2019 as assessed by IRAS Assessable Income AI for the Year of Assessment YA 2020 must not exceed 28000. Those without these payment arrangements will receive cheques by 20 August 2021.

Under certain circumstances you can withdraw an amount from your IRA earlier without the penalty. Early withdrawals from your IRA before age 59½ are not only taxable at ordinary income rates but will also face a 10 penalty. Generally early withdrawal from an Individual Retirement Account IRA prior to age 59½ is subject to being included in gross income plus a 10 percent additional tax penalty.

In instances where the application forms are incomplete IRAS will reject the applications with reasons stated and the claimants will be asked to re-submit a properly completed application form. With this planning strategy one must be careful not to exceed Medicaids income limit as the payouts will be counted as income. Businesses will receive more than S470 million in rental relief from Nov 26 under the third Rental Support Scheme payout IRAS and MOF said on Mon.

Those who submitted an application to IRAS for the first payout need not apply for the second one. There will be no revisions to the cash payout amount even if there are subsequent changes to the rent during the qualifying period. The IRS waives the 10 percent early withdrawal penalty for first-time homebuyers.

Cash it Out Spend Down One can cash out their retirement plan and spend down the extra assets on non-countable assets. Eligible tenants and owner-occupiers with PayNow or existing GIRO arrangements with IRAS can expect to receive the RSS cash payouts from 6 August 2021. Others may move their assets into their new employers plan.

To make it undesirable to withdraw early from an IRA the IRS imposes a 10 penalty on the amount you withdraw and also assesses income taxes on the withdrawn amount. How much you will pay in taxes when you withdraw money from an individual retirement account IRA depends on the type of IRA your age and even. There are exceptions to the 10 percent penalty such as using IRA funds to pay your medical insurance premium after a job loss.

Cashing out an IRA before the age of 59-12 means paying an initial 10 taxation. The first and second cash payouts are based on the contracted gross rent as indicated in the stamped lease agreement. Those 50 or older.

Will IRAS increase the cash payout. However there are always exceptions to every rule and that includes your IRA. Subscribe to receive SMS notifications when your tax bill is ready for viewing on myTax Portal if you.

You can make early withdrawals and still pay. Upon receipt of the properly completed application form relevant annexes and hire-purchase template where applicable IRAS will generally make the cash payout within three months. Under the PIC Cash Payout eligible businesses can apply to convert up to 100000 of their total expenditure for.

For 2021 those under age 50 can make a total contribution into their traditional and Roth IRAs of up to 6000. If you return the cash to your IRA within 3 years you will not owe the tax payment. From May 2021 most IRAS notices will be digitised with paper notices minimisedAccess your tax notices instantly anytime and anywhere on myTax Portal a safe and secured platform.

In general an IRA is meant to be held until the age of 60 but it. The first payout totalling S216 million was disbursed in August. For qualifying expenditure incurred from YA 2013 to 31 July 2016 the cash payout conversion rate is 60.

Boost Your Tax Savings For 2013 Ocean Systems Investing Incentive

2

2

Mistakes To Avoid When Claiming Iras Pic Infographic Pics Digital Camera Infographic

2

Pic Scheme Singapore Is Mobile App Claimable In Iras Pic Job Hunting Mobile Marketing Twitter Jobs

Singapore Circuit Breaker Assistance Singapore Breakers Money Lender

2

2

Recently Iras Added Website Development Cost To Be Able To Claim Under Pic Look At This Link Pic Faq Website Development Web Development Design Development

2

Productivity And Innovation Credit Pic Cash Payout Application Form