Interest Rate Parity Formula - F Si q - i b Where. Forward exchange rate based on Interest Rate Parity.

Interest Rate Parity Youtube

Plugging in the above formula yields.

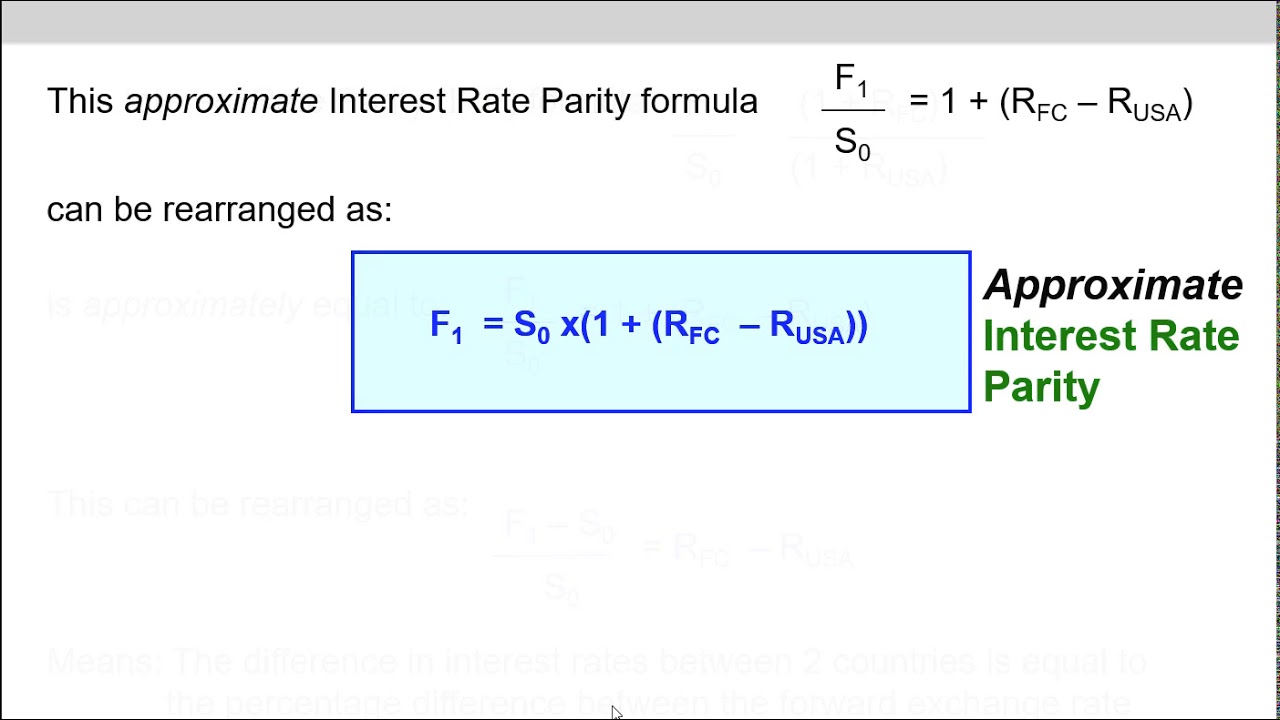

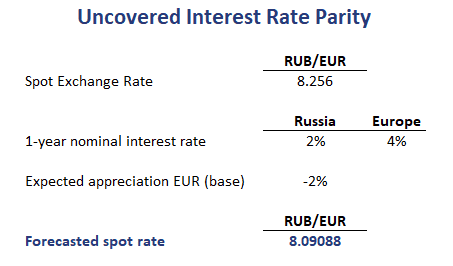

Interest rate parity formula. As per interest rate parity theory the difference in exchange rate between two currencies is due to difference in interest. Forward Premium Discount--Forward premium or discount. Since the two values are approximately equal therefore interest rate parity exists.

This would result in a forward rate of 1279100. The spot rate is the current exchange rate and the forward rate is the rate that a bank agrees to exchange one currency for another in the future. June 5 2010 at 512 pm 62127.

Is a theory used to explain the value and movements of exchange rates. Interest rate parity IRP A condition in which the rates of return on comparable assets in two countries are equal. The two key exchange rates are the spot rate and the forward rate.

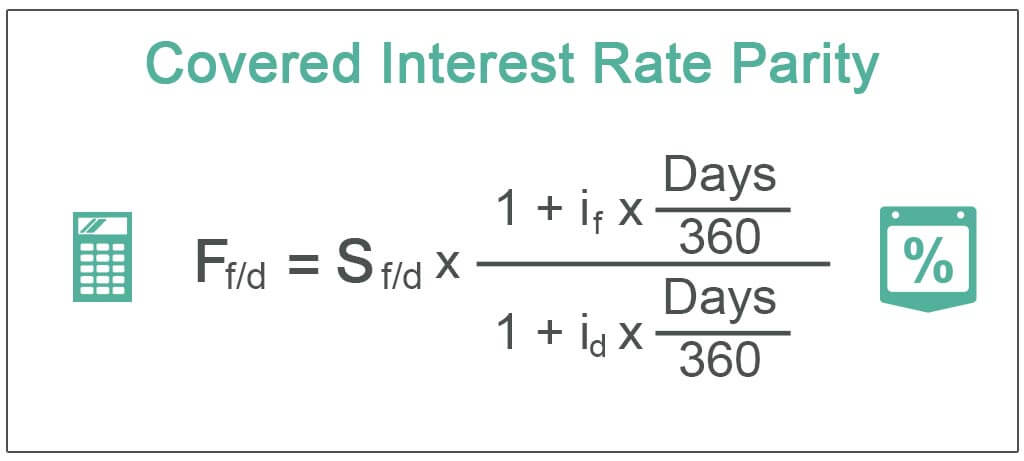

I d T h e i n t e r e s t r a t e i n t h e d o m e s t i c c u r r e n c y o r t h e b a s e c u r r. The left side is equal to 10196. The Formula for Covered Interest Rate Parity Is.

Check whether interest rate parity exist between USD and CAD. To find the forward exchange rate needed for equilibrium both sides can then be multiplied by the spot exchange rate which is shown as. Use tab to navigate through the menu items.

Also the risk-free interest rate is 4 for USD and 3 for CAD. Interest rate parity is a theory that suggests a strong relationship between interest rates and the movement of currency values. The formula to determine the forward foreign exchange rate is the following.

Ratio of Forward to Spot 12380 12500 09904. It is also known as the asset approach to exchange rate determination. BT was F1 MA was F2 FA was F3 PM was F5 FR was F7 AA was F8 FM was F9.

F S 1 i q 1 i b A simpler version. In terms of the rates of return formulas developed in Chapter 15 Foreign Exchange Markets and Rates of Return interest rate parity holds when the rate of return on dollar deposits is just equal to the expected rate of return on British deposits that is when. There is interest rate parity formula in BPP Book page 330 F S X 1ic1ib what value come in ic and ib place.

I refer to interest rate and C and B refer to country C and B. 1 i d F S 1 i f w h e r e. Ratio of Returns 13 141 09904.

Its equivalent in the financial markets is a theory called the Interest Rate Parity IRPT or the covered interest parity condition. The interest rate parity theory A theory of exchange rate determination based on investor motivations in which equilibrium is described. Both sides would need to be equal for there to be interest rate parity.

The Power Parity Principle PPP gives the equilibrium conditions in the commodity market.

Ppt International Parity Conditions Powerpoint Presentation Free Download Id 6801710

10 Of 18 Ch 21 Interest Rate Parity Derivation Of Formula Youtube

Using Interest Rate Parity To Trade Forex And With It Stop Loss Limit Forex

Chapter 15 Exchange Rates Interest Rates And Interest

Lectures 22 23 Determination Of Exchange Rates Building Blocs Interest Rate Parity Money Demand Equation Goods Markets Flexible Price Version Ppt Download

Interest Rate Parity Wikiwand

Solved What Is The Difference Between Those Formula Calculating 1 Answer Transtutors

Covered Interest Rate Parity Cirp Definition Formula Example

Interest Rate Parity Defined Covered Interest Arbitrage Interest Rate Parity Exchange Rate Determination Reasons For Deviations From Interest Rate Parity Ppt Download

Uncovered Interest Rate Parity Breaking Down Finance

13 Of 18 Ch 21 Uncovered Interest Parity Youtube

Implications Of Uncovered Interest Rate Parity Condition Personal Finance Money Stack Exchange

Purchasing Power Parity Interest Rate Parity International Corporate